What Term Is Used to Describe an Overvalued Stock Market

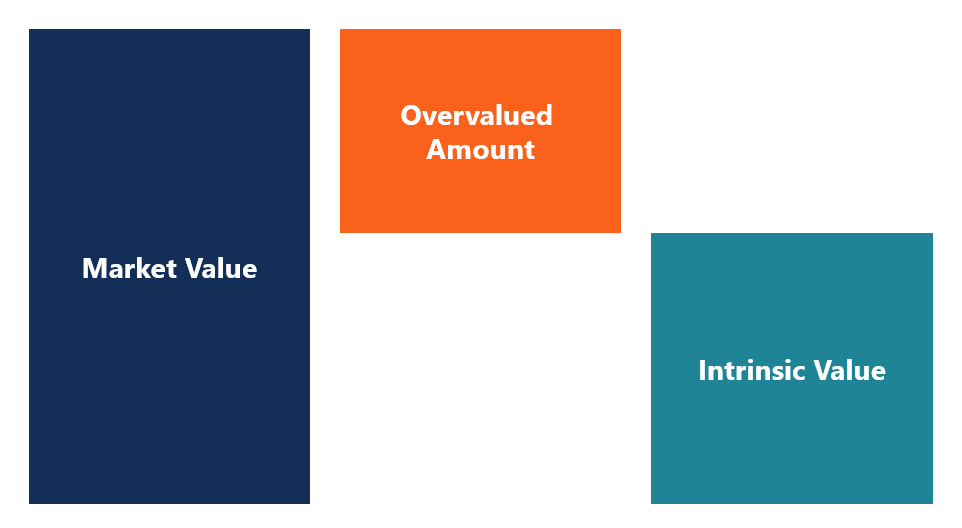

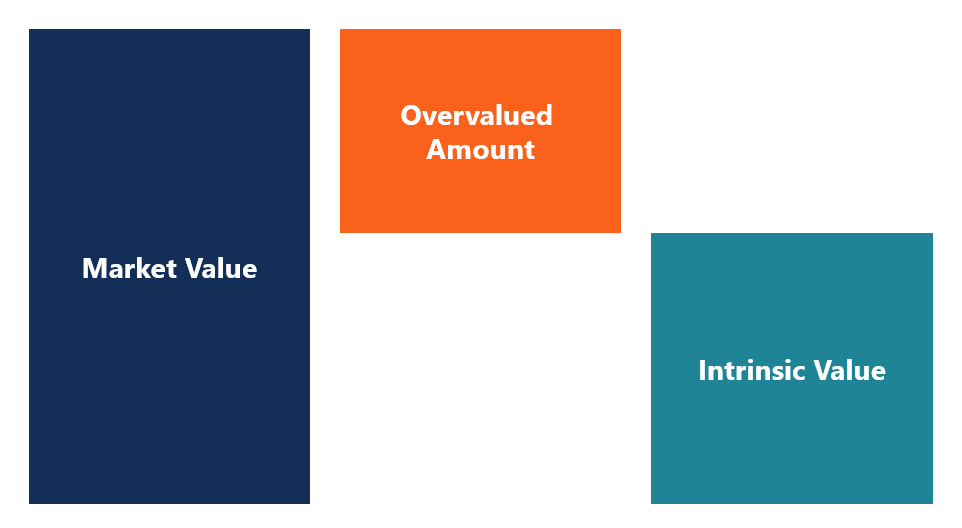

Bottom line Valuing a business is oftentimes more of an art than a science. Overvalued Meaning Overvalued means the current share price is higher than its intrinsic value or its real worth.

Overvalued Definition Intrinsic Value Ratios For Overvalued Investments

An apparent bargain may actually be an overvalued stock.

. As a result they have an inflated PE Ratio compared to their fundamental value found using DCF. A Stock Market Bubble is a rapid escalation in share value with no increase in companies values. The market being overvalued means that stock prices.

The market for our purposes the securities that comprise the US. Economy or a group of stocks that represent the US. Given this you can correctly assume that.

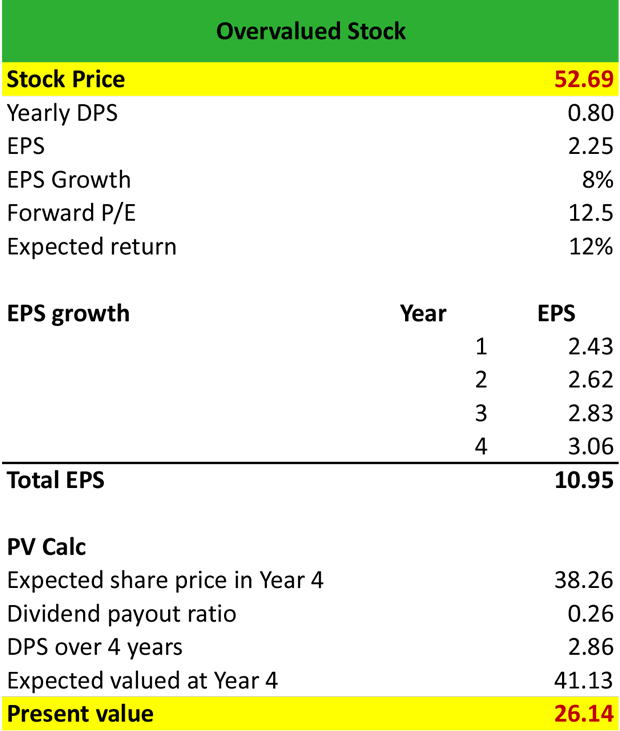

An overvalued stock has a current price that is not justified by its earnings outlook known as profit projections or its price-earnings PE ratio. Overvalued describes a security for which the market price is considered too high for its fundamentals. When a stock is undervalued it trades at a share price thats below what the stock is actually worth.

Economy such as the SP 500. In the stock market prices that seem to be undervalued can become more undervalued. Toppy is a financial slang term used to describe markets that are reaching unsustainable highs.

Overvalued stocks are those whose current price does not do justice to the earning potential. Some analysts believe there is another market bubble about to pop. What Is Overvalued.

Individual companies industries and sectors of the stock market can be temporarily overvalued. In other words paying that amount of money for a stock is. An overvalued stock is the opposite of an undervalued stock.

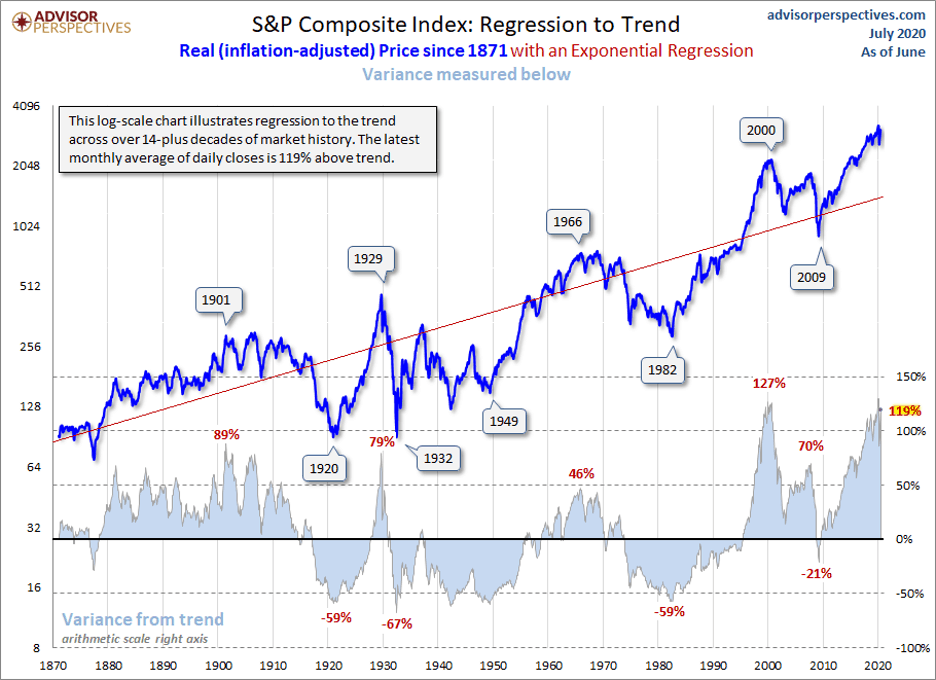

Earnings sales fixed-asset values gross domestic product and regression analysis. But looking at valuation ratios what. A toppy stock market climbs to new highs and then retraces.

An overvalued asset is an investment that trades for more than its intrinsic value. What Is an Overvalued Market. Some metrics used to evaluate whether a security is.

Knowing how to insulate your portfolio. The market typically refers to all stocks in the US. By just about every conceivable measure stocks today are overpriced.

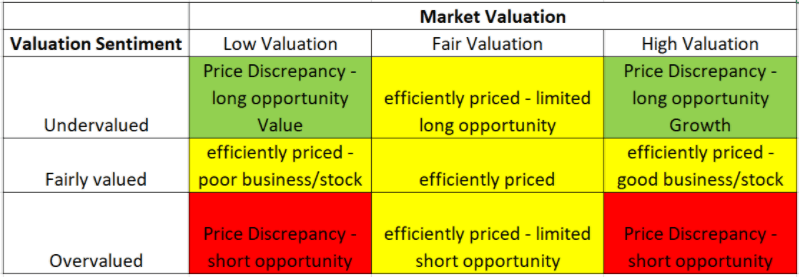

In the chart below I summarize the seven different valuation. For example if a company with an intrinsic value of 7 per share trades at a market value 13 per share it is. Stock A earns an annual return of 99 percent as compared to 96 percent returns on stocks B and C.

The price-to-earnings PE ratio also known as an earnings multiple gives you a quick way to figure out a stocks value but it doesnt mean much until you know how to read. In a classic Stock Bubble share prices far exceed companies. What is Overvalued.

Yet they keep going up. Stocks A B and C have identical risks. This is why it can.

To put in the simplest possible terms an overvalued stock is a stock that is trading at a price that is unreasonable. If one has a price level that is disproportionately high relative to its earnings it could be considered overvalued. Whats Ahead examines this extraordinary phenomenon in a segment that first.

For investors an overvalued market begins to sting when it experiences a significant extended downturn versus occasional dips. Its made up of corporate stocks government. Trading economy is an unwieldy beast.

Overvalued and undervalued are opposite of each other and denote the stocks pricing in comparison to its earnings. Overvalued stocks and markets can become more overvalued. In simpler words overvalued simply means the share price is.

Outperform Rating - When an analyst gives a stock an outperform rating it is an indication that the analyst expects the stock to beat the market or market index for that stock Outstanding. When a stock is low priced as compared to its earnings. Usually an entire sector becoming overvalued means a bubble is preparing to burst.

How To Differentiate Highly Valued From Overvalued Stocks To Beat The Market Part 1 Seeking Alpha

What Is An Overvalued Stock Definition Meaning Example

No comments for "What Term Is Used to Describe an Overvalued Stock Market"

Post a Comment